Sometimes the cost and effort to take care of our homes can start to weigh on us. Cleaning gutters, mowing the lawn and shoveling snow can make downsizing feel like an attractive option. The idea of downsizing however, can lead to many conflicting emotions. What are the options when it comes to retirement and how could we best use our real estate to help us reach our goals?

What is the #1 thing we hear from our clients after they downsize...

They wish they had done it sooner.

What are some common barriers for downsizers?

1. Leaving a much-loved family home

The emotional connection with a home is the top psychological hurdle in making a move. Even if selling the home has been on the table for a while, the reality of leaving a loved home for both the seller themselves along with extended family can be an emotional process. Understanding these affects and focusing on the financial and lifestyle benefits of the transition will help with the ultimate decision.

2. Facing a daunting decluttering task

Let's face it, most of us accumulate a lot of stuff! The longer a family lives in a home usually equates to more accumulated possessions and memories to deal with. The act of sorting, packing and discarding our possessions can feel overwhelming.

Starting early to declutter and organize the home is a great place to start. Also having professional help can be just enough to get over the initial hurdle and get the process moving.

Linda at Out Of Chaos is a fantastic resource. They are experts in home organization, decluttering and moving services. They have helped many of our clients get a jump start on their home.

3. Selling your home comes with a cost

There are certainly costs involved in selling your home, such as moving costs and real estate fees. The benefit however is that if it has been your primary residence you will not pay the capital gains tax. Should you decide to gift your home to your children you run the risk of getting the asset taxed at probate or triggering the capital gains tax at the time of transfer. It is important to understand the tax ramifications of real estate transfers and speak with an accountant to help with estate planning early. When it comes to large gifts, it’s important to realize that there is no gift tax tax in Canada. Often selling your home free of capital gains and then gifting an early inheritance is an excellent strategy.

4. Change can be hard

Some of us are better at change than others. New surroundings and a change of environment can be healthy but it can also be challenging. It is always best to make the change before you need to. If forced into selling a home due to finances or health issues it will always be harder. A positive attitude and excitement about a fresh start goes a long way in ensuring the move will be a success!

What are some of the benefits of downsizing?

1. Increased Leisure - With a smaller property comes fewer possessions and also the convenience of outdoor areas that are low or no maintenance

2. Lifestyle Benefits - Living in a more walkable location, or in a property that you can simply 'lock and leave'

3. Financial Freedom - Selling a large family home, opens up possibilities such as overseas travel, creating passive income, diversity of investments or simply a more comfortable retirement

4. The Gift Of Time - More quality time with grandchildren, family and friends

5. Social Engagement - Surrounding yourself with a likeminded supportive community to enjoy activities, hobbies and events which helps to maintain a sense of purpose and companionship for retirement

What other options are available outside of a retirement home?

With the price of retirement homes these days, it is no surprise that people are getting creative. The Global News article about the retired couple who booked 51 cruises back to back because it was cheaper than a retirement home is certainly a creative approach! See the news article here if a World Cruise sounds like your ideal transition from home ownership. Extravagant travel aside, there are many additional options to consider when it comes to transitioning from your much-loved home and downsizing. Here are a few ways that we have been able to help our clients with their real estate and retirement goals.

55+ Living on the North Shore

There are multiple opportunities on the North Shore when it comes to 55+ communities. These apartment buildings provide 1 or 2 bedroom units which cater to this demographic. The condos are typically slightly under market value due to the age restriction. Safe and low maintenance, this provide an opportunity to get involved in events and activities along with a fabulous connection to community.

SOMERSET GREEN - 121 West 29th/ 2800 Chesterfield Ave, North Vancouver

VISTA 29 - 188 West 29th St

QUEENSBROOK - 678 West Queens Rd

RIDGE PARK GARDENS - 2059 Chesterfield Ave

EDGEMONT VILLA - 3151 Connaught Crescent

HIGHLAND HOUSE - 3088 Highland Boulevard

BALMORAL HOUSE - 960 Lynn Valley Road

KIRKSTONE GARDENS - 2020 Cedar Village Crescent

For more information on what listings are currently available in these 55+ buildings specifically, please contact us.

Multi-Family Homes with Suites

Due to affordability for the next generation, we are seeing many more families opt to pool their money and purchase a multi-family home. These detached homes with suites provide separation and independence for parents, children and grandchildren while still having the benefit of close proximity to help when needed. This can also be the perfect way to pass on generational wealth through real estate.

For more information on what listings are currently available for detached homes with suites specifically, please click here.

Purchase of Multiple Properties for Inheritance Gifts and Passive Income

Passive income is a huge component of retirement. Some people are lucky to have a workplace pension, many are not. Having your wealth tied up in your primary residence can affect the ability to pay your day to day living expenses required once your income is reduced. Selling the larger family home and purchasing two properties is a fabulous way to diversify by living in one and renting the other for passive cashflow. This way you are still holding your equity and not diminishing your wealth with consumer expenses. If being a landlord isn't a priority, creating a 'rent to own' option for a child might be the perfect solution. By gifting the money and having your child purchase the condo, you're setting up the next generation with an affordable living arrangement, saving the wealth transfer taxes and creating passive income for yourself.

We have helped many clients with this concept. Please contact us to find out how we can help!

Reverse Mortgage for Creating Passive Income Through Investment

Reverse Mortgages have received a bad reputation in the past and rightfully so. With initially high interest rates quietly depleting your equity, home owners have found themselves in less than ideal situations. The good news is that Reverse Mortgages have greatly improved and can be an ideal tool in the right scenarios. If you are wanting to stay in your home just a bit longer, hoping to help family with a one-time gift or needing some extra funds for a large home maintenance item, this can be a fabulous way of accessing some of your equity. Another advantageous use of a reverse mortgage could be to purchase a secondary investment property and create cashflow. That cashflow could pay your living expenses all while maintaining your equity in real estate and allowing you to stay in your home. This could also give you the opportunity to pass some of your wealth to the next generation early and create a 'rent-to-own' scenario for children as explained above. As with all things mortgage, we defer to the experts. Keegan Casidy is one that we trust. Having an excellent mortgage broker who can explain the pros and cons of this strategy is an absolute must!

Keegan Casidy - Keegancasidy.ca

If you have read all the tabs and gotten this far...

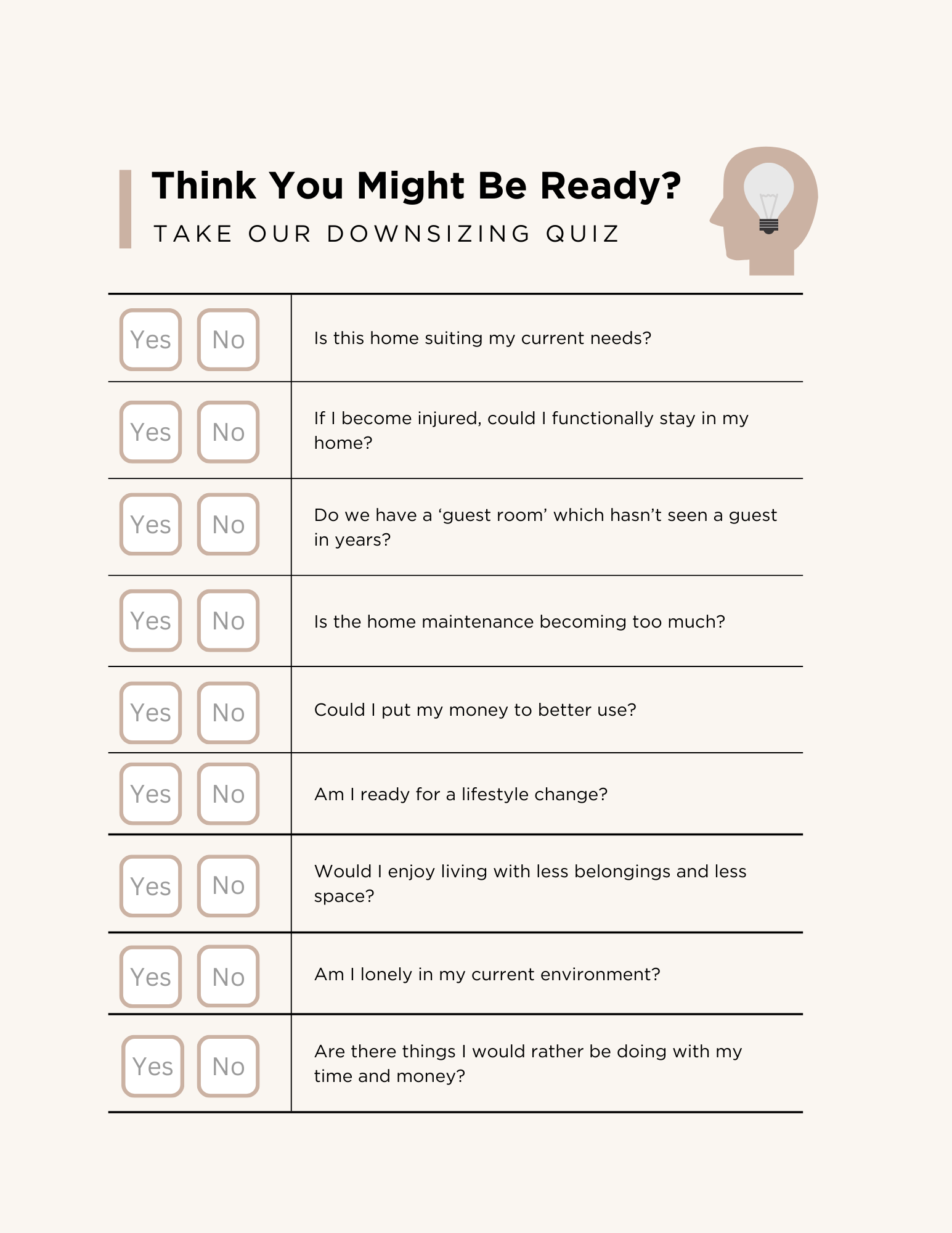

Downsizing might be worth investigating further. Take our 'Think You Might Be Ready' Quiz.